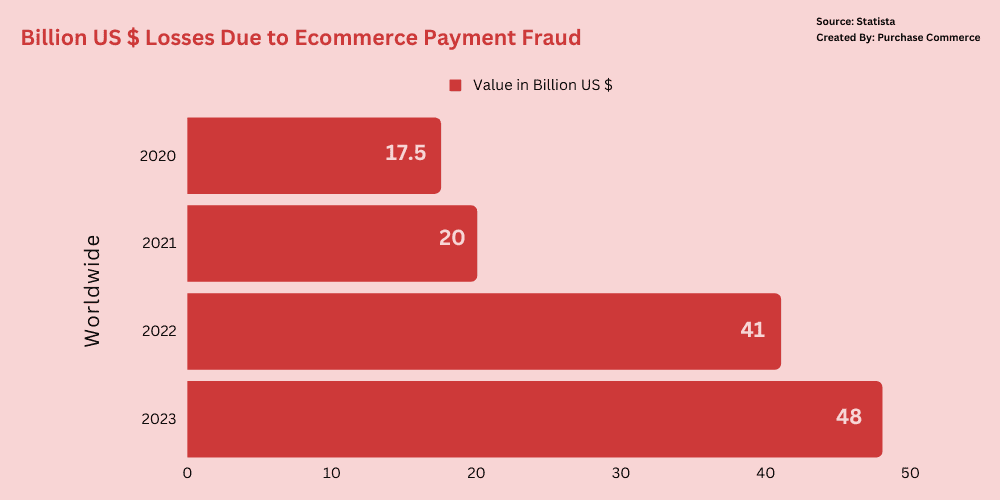

The rise of the eCommerce industry has also invited numerous security threats, especially those related to transaction payments. This holds true for online payments as well as orders that are paid for via cash-on-delivery.

It is also one of the reasons why some customers are still hesitant to purchase online and conduct any type of online transactions. They fear that they would be unwittingly giving out sensitive information to online stores or worse, other malicious actors preying on unassuming people. Some of them even fear the hassle of dealing with complex return or refund processes.

It is predicted that the cost of online payment fraud will reach US$206 billion by 2025.

If unaddressed, security issues can put your online business’ growth trajectory on pause. The only way to overcome this hurdle in eCommerce growth is to have a solid payment security system so that you can smooth checkouts and successful purchases.

A secure payment system can not just increase the safety of transactions but also instill trust in customers for your brands. After all, customers are more likely to purchase from brands that guarantee that their data and money is in safe hands, than others. So, even if you are going ahead with eCommerce replatforming for your website, you should keep payment security as a key consideration.

Let us look at some of the primary ways eCommerce owners can strengthen their online payment security.

1. Multi-Factor Authentication

Having a strong authentication process for your customers is the preliminary step towards better security in transactions. As a result, it has become a necessity for all eCommerce businesses to follow a two-factor or multi-factor authentication process. It is where users have to verify two or more verification factors before they can access their accounts. It reduces the number of fraudulent logins and anonymous account hacks.

For instance, you can have your customer receive a one-time password on their mobile phone or email and have them enter it, even after they enter their password or PIN.

You can choose reliable multi-factor authentication such as SMS codes, one-time passwords on emails or messages, mobile apps, or hardware tokens. Before you implement it, please make sure that you provide clear instructions and support for setting up multi-factor authentication to provide a smooth user experience.

2. End-to-End Data Encryption

End-to-end encryption of data involves converting regular text into ciphertext, rendering it impossible for hackers to decipher user data unless they have a description key. Data encryption ensures that even if the payment data is threatened and ends up in unauthorized users, it won’t be comprehensible for the users.

Apart from giving you protection against data breaches, data encryption also ensures that you stay compliant with regulatory bodies that mandate encryption to protect sensitive information. Some of the protocols that are used to encrypt data are TLS (Transport Layer Security) and SSL (Secure Sockets Layer). They guarantee data integrity and authenticity in online communications.

3. Enable Fraud Prevention and Monitoring Systems

As an eCommerce company, you need to have your in-house regulatory standards for fraud detection and eCommerce monitoring tools that provide a comprehensive outlook of site performance and occurrences that pose a threat to security. These tools will also give you insights that will help you strengthen your bug management strategies so that they do not lead to any security risks.

Statistics show that the average eCommerce industry uses at least five fraud detection tools.

Some of these methods can include having an address verification system, sophisticated algorithms, and machine learning tools to assess real-time transactions and detect any possible attacks at the payment stage. Such systems and tools monitor behavior patterns and transaction patterns to prevent fraud and ensure payment safety. Integrating a layer of identity theft protection through providers like Aura can help detect when personal information has been compromised, which often precedes larger business security incidents.

4. Double Down on Payment Gateway Security

As an eCommerce store, you will inevitably implement a payment gateway to process customer transactions. But without the necessary security measures in place, your payment gateway can pave the way for a lot of issues. To avoid this, ensure that you have appropriate and robust authentication mechanisms in place, and that all your transactions are encrypted.

Additionally, you should also ensure that your software is regularly updated so that you have installed the most important security and privacy measures for the security of your customers. It is also recommended that you carry out periodic penetration testing and comprehensive security audits so that you can flag any potential issues in advance.

5. Maintain PCI Compliance

You’re probably aware of the Payment Card Industry Data Security Standards (PCI-DSS) that aim to prevent data breaches during transactional payment in eCommerce. Ensure that you meet the eCommerce security measures for accepting credit card payments set up by PCI.

Some of these rules include refraining from storing sensitive data, limiting data storage & access, securing business processes with firewalls, and staying up-to-date with security patches. You can do that by having secure payment providers’ hosted checkouts as they often meet these rules for you.

6. Payment Tokenization

One of the ways you can ensure payment security is by enabling tokenization in the payment processor where the credit card data is converted into a token which is a string of randomly generated numbers.

This is practiced so that the original data is protected and at the same time payment gateways can securely access the cardholder data and facilitate a secure payment for eCommerce transactions.

7. Train Employees for Security Measures

At the end of the day, implementing a security culture in your eCommerce can go a long way in ensuring the safety of transactions and boosting brand reputation. Take proactive steps to ensure that your team understands what payment security is in eCommerce and why it holds significance for your business and your customer experience.

Train them in a manner that the employees can recognize potential threats and take appropriate action before the threats cause irreparable damage. You can also set up seminars and sessions where an expert educates them on data protection guidelines, security measures, and regulations, and how they can take individual responsibilities to identify threats in advance and work on risk mitigation at the time of order payments.

Wrapping Up

As threats to eCommerce businesses and their customers become more sophisticated, your security needs to keep up with adopting advanced measures to prevent fraud and losses. The aforementioned points are a good starting point to address security issues at the stage of payment and help you deep dive into implementing a full-fledged security system for your online business.

Author Bio:

Carl Torrence is a Content Marketer at Marketing Digest. His core expertise lies in developing data-driven content for brands, SaaS businesses, and agencies. In his free time, he enjoys binge-watching time-travel movies and listening to Linkin Park and Coldplay albums.