In India, the preferred mode of payment for online purchases is cash on delivery (COD), which constitutes over 50% of all electronic commerce transactions in the nation.

No matter what eCommerce brands think, the Cash on Delivery payment method is preferred by customers from Tier 2 & Tier 3 cities mostly. Therefore, d2c brands can never completely stop offering this payment method or they may lose a huge section of customers & profits.

That being said, COD payment method has loads of disadvantages for brands. How to fix them?

Go through our blog that talks about- how to turn Cod disadvantages into advantages & get the answers!

Why do Customers choose COD Payment Method?

Customers in India choose COD payment methods due to several factors, such as the extensive reliance on physical currency in daily transactions, lack of trust in new d2c brands, and the prevailing skepticism towards online payment systems.

Disadvantages of Cash on Delivery Payment Method

- RTO Risks- COD leaves eCommerce vulnerable to losses due to order cancellations and rejections, known as return-to-origins (RTOs). These trigger added expenses: forward and reverse logistics, operational costs, packaging, and product damage.

- Financial Strain- COD proves expensive as missed deliveries lead to extra trips, increasing costs for fuel and lost time. These costs are borne by sellers, impacting earnings.

- Cash Flow Constraints- COD’s delayed payments tighten businesses’ capital flow, especially for smaller eCommerce ventures heavily reliant on these sales. Rejected orders worsen the cash crunch through RTOs.

- Cash Management Complexity- Partnerships with multiple logistics firms for COD collections result in additional expenses. Handling this cash and reconciling it with delivery notes becomes more intricate as transaction volumes rise.

- Strategic Consideration- While COD has merits, businesses must judiciously assess drawbacks such as potential losses, high costs, cash flow limits, and intricate financial management. In this dynamic landscape, informed choices are crucial for balancing convenience and financial stability.

6 Tips to Manage Disadvantages of Cash On Delivery

1. Enhance Address Accuracy

The first tip to manage the disadvantages of cash on delivery is all about ensuring successful deliveries by collecting precise delivery addresses from customers. Guide them to provide essential details like house numbers, landmarks, phone numbers, and pin codes for smoother transactions.

2. Pay Attention to Customer Analysis & Confirming Risky Orders

Utilize AI automation-based shipping solutions like Shipway to actively engage with customers and monitor their purchasing behavior, enabling the identification of trends and targeted actions such as blocking specific pin codes or customers with high cancellation rates, primarily benefiting registered users and encouraging their logins for deeper insights.

Consider implementing the strategy of disabling COD payments for customers displaying repetitive order cancellations; if a customer has canceled multiple orders, it’s prudent to remove the cash payment option for subsequent orders to mitigate risk.

Leverage modern AI-powered automation solutions provided by reputable logistics providers, which categorize COD orders into high, medium, and low-risk segments, facilitating the promotion of prepayment for high-risk orders while excluding COD as a payment option.

3. Provide Real-Time Order Updates

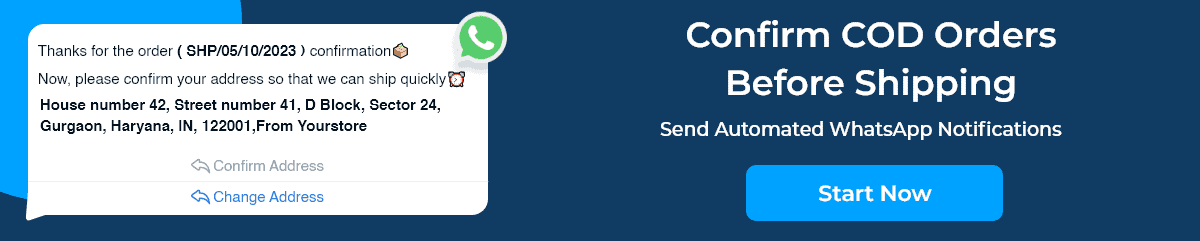

Keep customers informed with regular updates through platforms like WhatsApp. Timely notifications about order progress instill confidence reduces cancellations & missed delivery attempts and enhance customer satisfaction.

4. Put Purchase Limits for COD

Implement minimum and maximum purchase limits for COD orders to manage risks effectively. Furthermore, avoid providing COD payment options for expensive products.

5. Opt for a Shipping Solution that provides Early COD Remittance

The next tip for managing the disadvantages of cash on delivery is selecting a shipping solution that offers Early COD remittance. By doing this, you can avoid the restriction of cash flow that happens due to cod payments. Solutions like Shipway offer Early COD remittance in which you can receive the payment within D+2, D+3 & D+4 days.

6. Promote Prepaid Payments

To encourage more prepaid orders, consider incentivizing customers during checkout. With 70% of Indian customers favoring COD, this tactic can drive immediate payments.

Display messages like “Save INR 200 by paying now” or “Miss out on INR 200 savings with COD,” appealing to their desire for savings. Additionally, offer a 10% discount on their next order for immediate payment, fostering repeat purchases and revenue generation.

This shift in approach can reshape customer behavior, promoting successful transactions and enhancing overall efficiency.

Final Takeaway

Cash on delivery method will always be the preferred method in India. By making use of our tips to manage the disadvantages of Cash on delivery, you can make COD as useful for you as it is for your customers.

Frequently Asked Questions

A

What are the advantages of COD payment method?

The advantages of the Cash on Delivery (COD) payment method include catering to customers without digital payment access, providing a sense of trust through physical verification before payment, minimizing online fraud risks, and appealing to those who are cautious about online transactions.

What are the disadvantages of COD payment method?

The disadvantages of the Cash on Delivery (COD) payment method encompass higher operational costs, cash handling vulnerabilities, increased potential for returns and cancellations, delayed payments impacting cash flow, and a restricted customer base due to excluding non-cash payers.

You may also like…

How to Effectively Reduce E-commerce RTO% in 2025?

E-commerce sellers know that RTO (Return to Origin) is a big headache. An RTO happens when an order doesn’t reach the customer and is sent back to...

read moreHow to Prepare Ecommerce Logistics for Festive Season Sales in 2025?

Festive seasons in India bring a huge surge in online shopping. For e-commerce sellers and logistics teams, this time of year is both a golden...

read moreFix Shipping Weight Errors with These Proven Tools

If you run an ecommerce business, you already know how important it is to get the shipping weight right. The weight you record for your products...

read more