Cash on Delivery (COD) and prepaid orders are the two dominant payment methods in e-commerce. While prepaid payments ensure immediate revenue and reduce return rates, COD attracts more customers, especially in markets where trust in online payments is low.

In India, Cash on Delivery remains popular and is also preferred by nearly 65% of Indian shoppers.

However, its hidden costs like high Return to Origin (RTO) rates and delayed cash flow can hinder growth. On the other hand, prepaid payments are continuously growing with each passing day and are projected to drive revenue beyond ₹225 billion by the year 2026.

In the below article, we will explain more about the impact of COD on eCommerce, how RTO (Return to Origin) affects the overall profitability, and some of the key strategies to transition from COD to prepaid payments for sustainable growth in the long run.

Understanding COD and Prepaid Payments

What is Cash on Delivery (COD)?

COD is a popular payment method where customers pay for their purchases after the final delivery (i.e. once they receive the product). It is a widely used payment method for online purchases. It is widely adopted in those areas where online payment trust is low or the digital payment adoption rate is limited.

COD builds trust among cautious buyers and expands the customer base. This is applicable in Tier 2 & Tier 3 cities. However, it comes with challenges like delayed cash flow, high return rates, and increased logistical costs. COD benefits the sellers by increasing the likelihood of successful sales, in regions where online payments are less common.

The COD Process

The COD process is straightforward:

- Payment Collection: Delivery agents collect the order’s invoice amount from the buyer at the time of delivery. It is usually done via cash or via card using a swiping machine.

- Cash Transfer: The collected cash is deposited at the logistics company’s local office. This further transfers the funds to the seller or supplier after deducting handling charges.

For sellers that want to simplify the COD cash handling, they need to ensure an immediate realization of proceeds without the risk of payment failures. However, sometimes it may pose challenges for high-value orders.

For buyers, COD is a preferred option as payment is made only upon delivery. It provides some kind of assurance of receiving the product. In case of damaged or incorrect deliveries, buyers can refuse the package, eliminating payment risks.

Why is COD Popular in India?

COD remains a preferred payment method in India due to its ease of use and the higher trust in cash transactions over digital payments like debit or credit cards. It acts as a safety net for customers wary of online fraud and payment failures.

What are Prepaid Payments?

Prepaid payments require customers to pay in advance during checkout using the available methods, such as credit/debit cards, UPI, or digital wallets. This model provides quick fund settlement, improves cash flow, and reduces the risk of product returns. Prepaid payments ease the entire logistics process and are generally more cost-efficient for businesses.

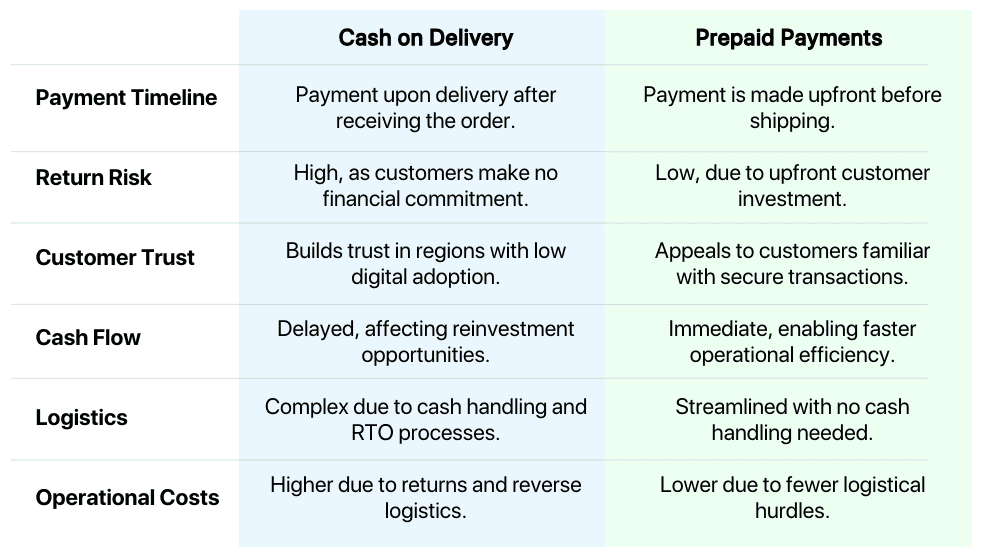

COD vs. Prepaid Payments: Key Differences

What’s the Ideal COD vs. Prepaid Split?

While there is no one-size-fits-all answer, industry trends suggest:

- 60:40 (COD: Prepaid) for new businesses in emerging markets

- 50:50 for mid-sized e-commerce brands optimizing for growth

- 30:70 or lower for established brands focusing on profitability

Optimizing your COD and prepaid order ratio is key to maximizing profits and minimizing losses. While COD drives conversions, it has many disadvantages, such as a higher chance of fraud orders and higher RTO rates.

A data-driven approach to analyzing customer behavior, return rates, and payment preferences will help your business strike the right balance.

Why is COD not the preferred mode of payment for e-commerce sellers?

COD increases RTO rates, creating financial & operational challenges for businesses. It is generally not preferred by e-commerce sellers because:-

- Lack of Financial Commitment: With no upfront payment, customers can easily cancel or refuse orders, leading to higher return rates.

- Impulse Buying and Fraudulent Orders: COD enables customers to order without serious intent, often leading to partial acceptance or fraudulent activities.

- Last-Minute Refusals: Customers may refuse delivery due to a lack of cash or a change of mind, particularly in regions where digital payments are uncommon.

- Delivery Complexities: Failed delivery attempts due to incorrect addresses or unavailable customers result in costly returns, especially for COD orders.

- Cashflow Issues: COD causes slower remittance cycles, which creates a cashflow challenge for small business owners. It impacts the growth of the business and causes operational issues.

Prepaid Payments: The Key to Reducing RTO Rates

Transitioning to prepaid payments offers a clear path to reducing RTO rates and improving profitability. Here’s how:

- Customer Commitment: Prepaid payments require financial commitment upfront, reducing cancellations and ensuring customers are serious about their purchases.

- Streamlined Logistics: Prepaid orders eliminate the need for cash handling, enabling faster delivery and fewer operational challenges.

- Improved Delivery Success Rates: Customers who pay upfront are more likely to provide accurate delivery details, minimizing failed delivery attempts.

- Lower Fraud Risk: Prepaid payments discourage impulse purchases and fraudulent behavior. It helps the business minimize financial losses.

How Shipway Helps Reduce COD Losses

Shipway is a popular shipping software that provides intelligent solutions and insights to help businesses minimize losses from COD orders while maintaining customer satisfaction.

1. Risk-Based COD Filtering:

Shipway’s COD fraud detection tools analyze orders and addresses to categorize COD orders as high-risk, medium-risk and low-risk customers. This helps in ensuring you make the right decision for your business and can reduce RTO rates by up to 30%.

2. COD Confirmation & Address Verification:

Ensures only genuine COD orders are processed, by confirming orders and getting the right address over WhatsApp.

3. Real-Time Order Tracking:

Customers receive real-time updates on their orders. It helps build trust and reduce the likelihood of returns.

A

What are the main challenges with COD payments?

COD payments often lead to higher RTO rates, delayed cash flow, and increased logistical complexities.

Why is reducing RTO critical for eCommerce businesses?

High RTO rates increase costs through reverse logistics and block inventory, impacting profitability.

How can businesses encourage customers to choose prepaid payments?

Sometimes different types of incentives like discounts and personalized offers can motivate the customers to choose the prepaid methods.

How do prepaid payments improve cash flow?

Prepaid payments provide immediate funds. As a result, it eliminates any type of delays due COD courier services and enables faster reinvestment in operations.

You may also like…

Top 10 India Delivery Company for E-commerce Businesses (2026)

Choosing the right India delivery company is crucial for eCommerce businesses looking to provide fast, reliable, and cost-effective shipping. The...

read more10 Fastest eCommerce Courier Partners in India for 2026

Finding a fast delivery service in India has become essential for every growing eCommerce brand. With customer expectations rising rapidly, online...

read moreTop 10 Logistics Companies in India for eCommerce (2026 List & Guide)

Introduction: Why Logistics Matters for India’s Growing eCommerce Sector The Indian eCommerce sector has witnessed tremendous growth, projected to...

read more