COD Payment vs Online Payment: Pros and Cons for Sellers & Small Businesses

Payment methods are a critical component for modern day small businesses and sellers operating in the e-commerce space. The choice between Cash on Delivery & Online Payment can influence customer experience, operational efficiency, and profitability. Each of these payment methods has unique advantages and disadvantages. And after understanding these can help businesses determine the most suitable options for their specific needs.

In the below post, we will explore the pros and cons of both COD and online payment methods for sellers and small ecommerce businesses.

Cash on Delivery (COD): Overview, Advantages, and Disadvantages

What is Cash on Delivery?

Cash on Delivery in the Indian eCommerce sector is a payment solution where customers pay for their purchases only once the product is delivered to their address. It is especially popular in regions with low trust in online transactions or limited access to digital payment systems.

Advantages of COD for Sellers & Small Businesses

- Attracts New and Hesitant Customers: COD eliminates the risk for customers who may distrust online payments, particularly in regions with a history of fraud or limited internet penetration. It allows hesitant customers to try new sellers without upfront payment.

- Increases Conversion Rates: Providing a COD option to customers can help in reducing the cart abandonment rates. This is because customers are not required to commit to payment during the checkout process.

- Expands Market Reach: COD enables businesses to target a broader audience, including customers who are unbanked or lack access to digital payment methods.

- Builds Trust: COD assures customers that they only pay upon receiving the product, enhancing trust in the business and encouraging repeat purchases.

- First-Time Buyers: Many first-time buyers prefer COD. As this reduces the perceived risk of purchasing from unfamiliar brands or platforms.

Disadvantages of COD for Sellers & Small Businesses

- High Return Rates: COD orders often result in higher Return to Origin (RTO) rates due to customers refusing delivery or failing to be available.

- Delayed Cash Flow: Sellers face delays in revenue realization since payments are processed only after successful delivery and reconciliation.

- Increased Operational Costs: COD orders involve additional costs, such as cash handling fees charged by logistics providers and higher reverse logistics costs in the case of returns.

- Fraud Risks: Fake or prank orders are more common with COD, leading to wasted resources and lost revenue.

- Cash Handling Challenges: Managing and reconciling cash collected by delivery personnel can be prone to errors, theft, or mismanagement.

- Dependency on Logistics Partners: Success of COD as a payment option, requires reliable COD delivery partners for cash collection, creating dependency and potential risks if reconciliation is delayed.

Online Payment: Overview, Advantages, and Disadvantages

What is Online Payment?

Online payments are those types of transactions that are completed digitally via payment gateways, mobile wallets, UPI, credit/debit cards, or net banking. Customers pay for their purchases at the time of checkout and hence this eliminates the need for cash transactions.

Advantages of Online Payment for Sellers & Small Businesses

- Immediate Cash Flow: Sellers receive payments instantly or within a short processing time, ensuring steady cash flow and improved liquidity.

- Reduced Operational Costs: Online payments eliminate cash handling expenses and reduce dependency on logistics partners for COD payment reconciliation.

- Enhanced Security: Digital payment systems use encryption and secure gateways to minimize the risk of fraud or theft.

- Lower Return Rates: Prepaid orders have significantly lower RTO rates since customers are less likely to cancel or refuse delivery after paying upfront.

- Streamlined Processes: Online payments in Ecommerce industry simplify record keeping, reconciliation, and accounting. This further helps in saving time & effort for businesses.

- Customer Convenience: Online payments provide a quality checkout experience. This is particularly helpful for tech-savvy customers that prefer quick and secure transactions.

- Supports Upselling and Cross-Selling: Digital payments provide businesses to integrate loyalty programs, discounts, and other marketing strategies. It helps to increase the repeat purchases.

- Global Reach: Online payment systems enable small businesses to cater to international customers, expanding their market reach.

Disadvantages of Online Payment for Sellers & Small Businesses

- Dependence on Technology: Online payments require a stable internet connection and reliable technology. This sometimes may pose challenges in areas with poor infrastructure.

- Payment Gateway Charges: Sellers must pay transaction fees to payment gateways. It can add up and reduce profit margins.

- Fraud Risks: In general online payments are highly secure. But, they remain vulnerable to cyberattacks, phishing scams, and chargebacks that were initiated by fraudulent customers.

- Customer Hesitation: In markets with low digital literacy or distrust in online transactions, customers may hesitate to use online payment.

- Technical Glitches: There occur certain instances when the Payment failed due to technical issues can frustrate customers & further loss of sales.

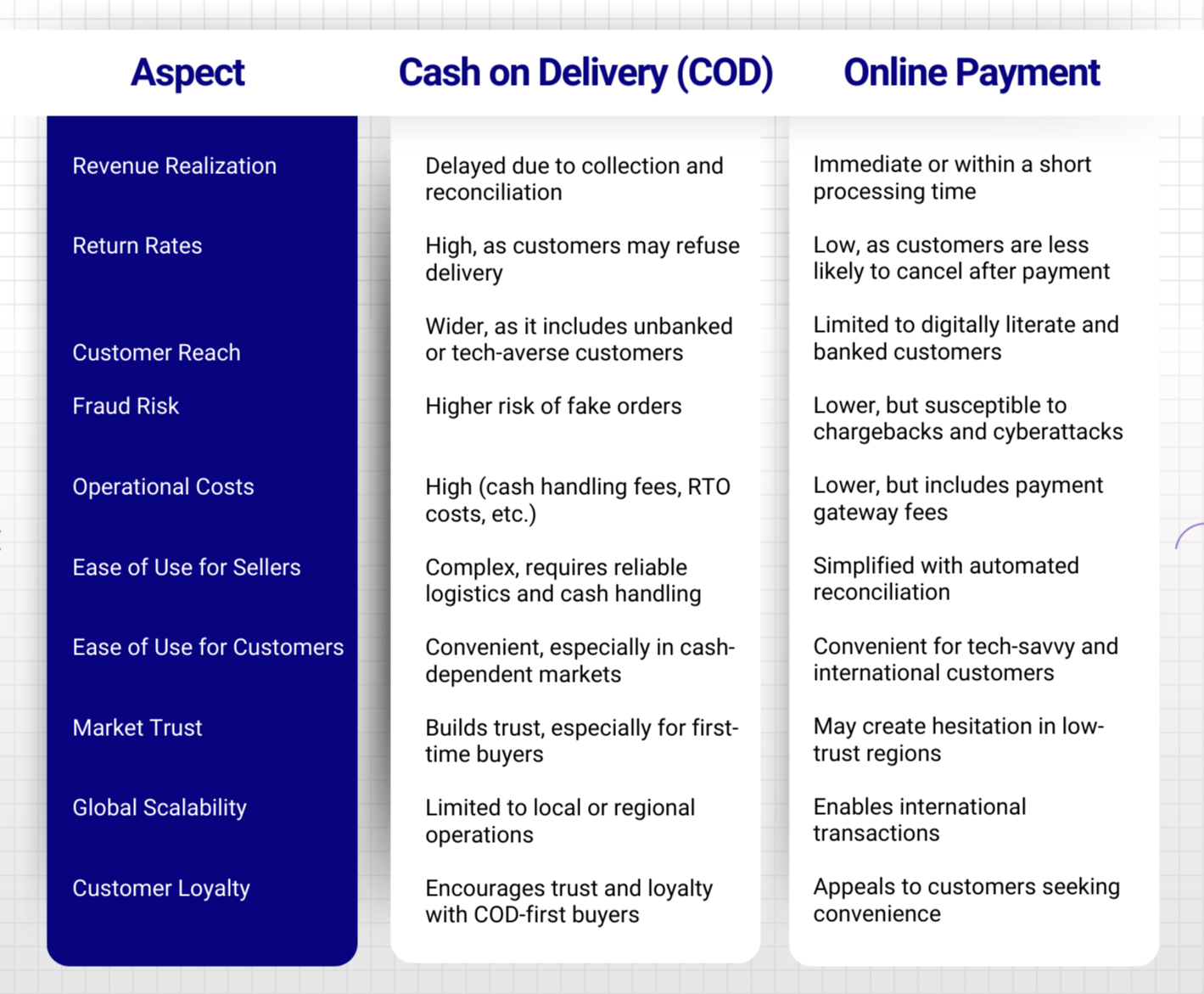

Comparison Table: COD Payment vs. Online Payment

Below is a detailed comparison table summarizing the pros and cons of COD and online payments

Which Payment Method is Better for Sellers and Small Businesses?

When is COD the Better Choice?

- Emerging Markets: COD works well in regions with low digital payment penetration or distrust in online transactions.

- First-Time Buyers: Offering COD attracts new customers unfamiliar with the brand.

- Lower-Value Products: COD is viable for products with minimal RTO impact and manageable logistics costs.

When is Online Payment the Better Choice?

- Digitally Mature Markets: Online payments are ideal where customers are comfortable with digital transactions.

- Higher-Value Products: Prepaid orders reduce risks associated with high RTO costs.

- Cross-Border Sales: Online payments enable global sales, making them indispensable for international business. Sellers operating across borders may also benefit from using a legal VPN to securely access global platforms and payment gateways.

Best Practices for Sellers Using Both Payment Methods

For COD Orders

- Pre-Dispatch Confirmation: Use automated calls or messages to confirm orders before shipping.

- Set Limits: Impose order value caps and restrict COD for high-risk products or regions. Set strict terms & conditions for COD orders.

- Charge a COD Fee: Offset additional costs by charging a nominal fee for COD orders.

- Monitor Fraudulent Behavior: Track and flag suspicious customers to prevent fake orders.

For Online Payments

- Choose Reliable Gateways: Partner with secure & reputable payment providers to minimize risks.

- Offer Multiple Payment Options: Fulfill the diverse customer preferences by enabling wallets, UPI, cards, and EMI options.

- Highlight Security Features: Build trust by showcasing secure payment icons and refund policies.

- Integrate Rewards: Businesses can encourage their customers for prepaid orders by providing attractive discounts, cashback, and some sort of loyalty programs.

Conclusion

Both COD and online payment methods have their own pros and cons and help businesses to increase their revenue. All this makes it essential for sellers and small businesses to assess their customer base, market dynamics, and operational capacities. While, cash on delivery (COD) can be a disadvantage for e-commerce businesses and sellers due to operational challenges, but it also helps build trust and attract first-time buyers. Meanwhile, online payments streamline processes and minimize risks.

The ideal approach for ecommerce businesses offering COD as a payment option is to offer a combination of both methods. It helps them to gradually transition customers from COD to online payments via providing incentives, education, and trust-building measures. After striking the right balance, sellers can increase their sales, minimize risks, and create top quality payment experience for their customers.

How to Select the Best AfterShip Alternative for Shipment Tracking?

The Complete Guide to White Glove Service: Benefits, Challenges & Industry Insights

Let’s paint a scenario: You send a piece of furniture to a customer using standard delivery, and it arrives damaged. The glass is shattered, or the frame is dented. That’s not just a loss for the customer, it’s a loss for your brand too. You now have to replace the...

read more

The Complete Guide to White Glove Service: Benefits, Challenges & Industry Insights

Let’s paint a scenario: You send a piece of furniture to a customer using standard delivery, and it arrives damaged. The glass is shattered, or the frame is dented. That’s not just a loss for the customer, it’s a loss for your brand too. You now have to replace the...

read more

The Complete Guide to White Glove Service: Benefits, Challenges & Industry Insights

Let’s paint a scenario: You send a piece of furniture to a customer using standard delivery, and it arrives damaged. The glass is shattered, or the frame is dented. That’s not just a loss for the customer, it’s a loss for your brand too. You now have to replace the...

read more